Canada’s next great economic boom can be unleashed by the power of housing, immigration, and labour

Canada’s next great economic boom can be unleashed by the power of housing, immigration, and labour

Expanded immigration can work hand-in-hand with the construction industry’s goals to open the way to build the 3.5 million additional homes we need above the current pace of construction.

OPINION | BY Mark Kenney | January 23, 2023

OTTAWA — With supportive proven public policy, Canada can combine much-needed immigration and home-building initiatives to unleash our next great economic opportunity.

We are currently facing a labour shortage of over 800,000 people and it will only persist as baby boomers retire. In short, as Immigration Minister Sean Fraser recognized on Nov. 1 when announcing Canada’s new expanded immigration targets: we need a lot more people.

At the same time, as the Canada Mortgage and Housing Corporation (CMHC) has noted, we need to build a lot more housing. Canada has the fewest homes per capita in the G7, but our population is growing the fastest.

Think about this: we have the most land, the lowest density, and yet, we have the highest prices.

We simply haven’t been building enough housing. Despite today’s growing population, we built more homes in the 1970s than we did in the 2010s or any decade in between. Back then, proven public policies were in place to encourage large-scale investment and construction of purpose-built rental housing. CMHC has said we need to build 5.8 million homes by 2030 to restore housing affordability. That means more than doubling our current pace of construction.

Addressing the housing crisis

On both points—the need for higher immigration targets and for millions more homes—we in the Real Estate Investment Trust (REIT) sector enthusiastically agree.

Now, some have criticized the expanded immigration target of almost 1.5 million people over the next three years, pointing out that we are facing the worst housing crisis in over 40 years. But we see it from a completely opposite perspective. Expanded immigration can work hand-in-hand with the goals of the construction industry to open the way to build those 3.5 million additional homes we need above the current pace of construction.

Why? Because immigration has historically been the best way to address the kind of serious labour shortage currently being experienced in housing construction, as Canada’s Building Trades Unions noted at the time of Fraser’s Nov. 1 announcement.

In combining the solutions to these two pressing challenges, we can fuel the next great economic boom in Canada while building the housing we need. By doing so, we can deliver for Canadians greater housing affordability and choice through an abundance of quality new homes that will be more energy efficient, helping meet our greenhouse gas reduction targets.

Governments should work with trade unions and colleges to develop streamlined training and apprenticeship programs to help new arrivals quickly re-certify or develop skills in the building trades, leading to solid middle-class jobs in communities across the country right out of the gate, and bolstering our aging building trades workforce.

Liveable communities

Affordable Acquisiton Fund

What about protecting existing renters? We believe there are smart policies that will allow the government to protect the long-term affordability for the least-advantaged renters at a fraction of the cost of new affordable housing. Championed by the NDP and supported by our industry, creating an Affordable Acquisition Fund would enable the transfer of existing market- based affordable rental apartments from the for-profit sector to nonprofits, co- operative and community land trusts (NPOs for short), making them permanently affordable.

These NPOs can do this with relatively little government support. In practice, governments could deliver large-scale permanent housing affordability for between one-third to one-half the cost of building new affordable homes. And another advantage would be that REITs, pension funds, and other large scale for-profit housing providers would reinvest the revenue from these transfers back into the economy, building new housing supply. Just last week, British Columbia Premier David Eby announced a $500-million acquisition program for that province; the federal government can take this approach and scale it nationally.

With a targeted immigration plan and policies that maximize the potential of housing providers such as REITs and Canadian investors, we can offer more people from around the world a chance at a better life while simultaneously providing a powerful, long-term strategy to address the country’s housing challenges—all while growing the economy for everyone’s benefit.

Mark Kenney is president and CEO at Canadian Apartment Properties REIT,

a member of Canadian Rental Housing Providers for Affordable Housing.

The Hill Times

More from Mark Kenney:

Op-ed: BC Landord – Canada’s Housing Crisis

https://www.capreit.ca/op-ed-canadas-housing-crisis/

Op-ed: As Canadian housing crisis rages on, is ‘financialization’ really to blame?

https://www.capreit.ca/op-ed-as-canadian-housing-crisis-rages-on-is-financialization-really-to-blame/

BNN Bloomberg Interview with Mark Kenney – The Housing Crisis in Canada

https://www.capreit.ca/bnn-bloomberg-interview-with-mark-kenney-the-housing-crisis-in-canada/

Canada’s next great economic boom can be unleashed by the power of housing, immigration, and labour

https://www.capreit.ca/canadas-next-economic-boom-can-be-unleashed-by-housing-immigration-labour/

BNN Bloomberg Interview with Mark Kenney – Incredible problems with lack of supply

https://www.capreit.ca/bnn-bloomberg-interview-with-mark-kenney-incredible-problems-with-lack-of-supply/

Celebrating 25 Years

https://www.capreit.ca/celebrating-25-years/

News

CAPREIT announces Release of 2024 ESG Report

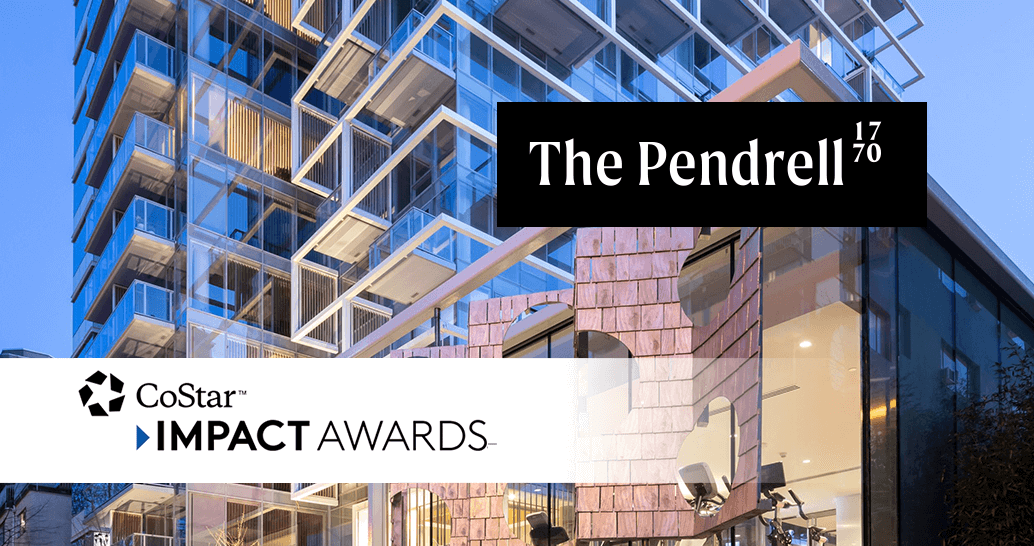

The Pendrell 1770 wins the CoStar Impact Award for Sale/Acquisition of the Year

Q&A with CAPREIT’s Julian Schonfeldt on the firm’s portfolio evolution

CAPREIT announces $194 million in new acquisition and disposition activity

CAPREIT Announces $104 Million Disposition in Montréal